📊 WEEKLY SNAPSHOT — Sept 29, 2025

Snapshot of market activity, protocol performance, and utilization.

🔍 Explore full analytics:

📚 Docs:

💧 Supply where it counts:

💧 1/ Total Value Locked (TVL)

• $121.68M locked (+1.29% WoW)

Liqwid TVL rose to $121.68M (+1.29% WoW) — steady growth despite wider market chop.

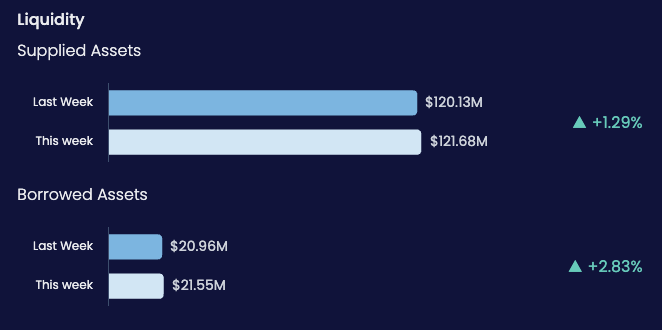

⚒️ 2/ Asset Liquidity Totals

• Supplied: $121.68M (+1.29%)

• Borrowed: $21.55M (+2.83%)

Supplied assets climbed +1.29%, while borrows grew faster at +2.83%, signaling stronger demand pressure.

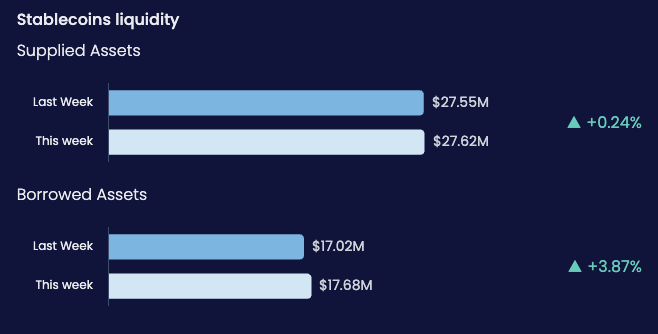

🏦 3/ Stablecoin Liquidity

• Supplied: $27.62M (+0.24%)

• Borrowed: $17.68M (+3.87%)

Stablecoin borrows hit $17.68M (+3.87%), keeping capital efficient and rates attractive for suppliers.

📈 4/ Top APY Markets (This Week)

• wanUSDC — 16.35% | $9.29M (+22.95%)

• DJED — 14.67% | $6.63M (-2.29%)

• wanUSDT — 14.35% | $2.56M (+19.86%)

• iUSD — 14.02% | $1.5M (-19.87%)

wanUSDC (+22.95%) and wanUSDT (+19.86%) saw sharp inflows, both sustaining double-digit APYs.

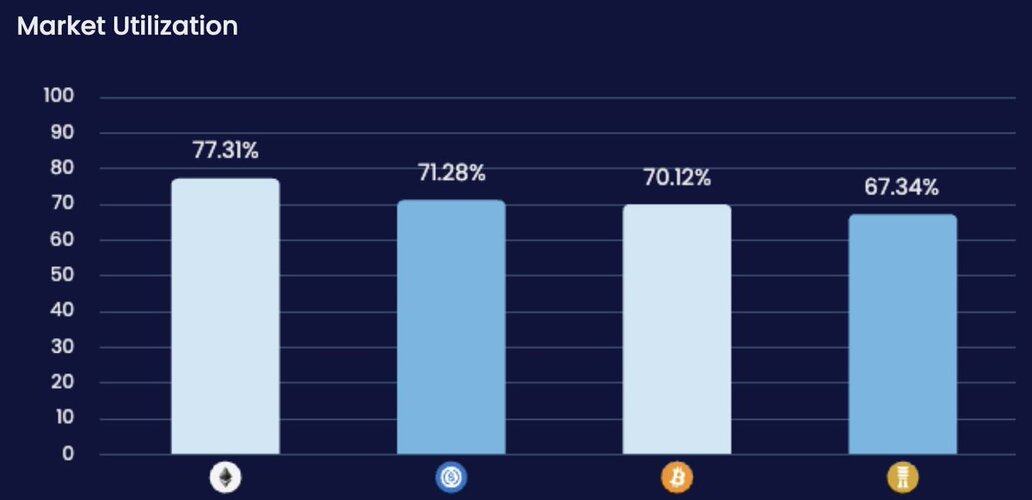

⚙️ 5/ Market Utilization (Top Markets)

• wanETH — 77.31%

• wanUSDC — 71.28%

• wanBTC — 70.12%

• DJED — 67.34%

wanETH, wanUSDC, and wanBTC each hold 70%+ utilization, highlighting consistent borrower demand across majors.

💰 6/ Revenue Breakdown (This Week)

• Debt Repaid: $259.11k (+211.84%)

• Interest Accrued: $78.29k (+3.29%)

• Fees Collected: $10.61k (+45.35%)

Weekly revenue surged — Debt repaid up 212%, fees +45%. A clear sign of active repayment cycles and healthy protocol income.

📊 7/ Capital Distribution

Supplied Assets:

• ADA — $44.81M

• wanUSDC — $9.39M

• LQ — $7.47M

• Others — $21.66M

Loan Value:

• wanUSDC — $6.62M

• DJED — $4.46M

• ADA — $3.4M

• Others — $7.06M

ADA remains the bedrock ($44.8M supplied), but stablecoins (wanUSDC $9.4M, DJED $4.5M loans) continue to anchor liquidity depth.

4,59 mil

0

O conteúdo apresentado nesta página é fornecido por terceiros. Salvo indicação em contrário, a OKX não é o autor dos artigos citados e não reivindica quaisquer direitos de autor nos materiais. O conteúdo é fornecido apenas para fins informativos e não representa a opinião da OKX. Não se destina a ser um endosso de qualquer tipo e não deve ser considerado conselho de investimento ou uma solicitação para comprar ou vender ativos digitais. Na medida em que a IA generativa é utilizada para fornecer resumos ou outras informações, esse mesmo conteúdo gerado por IA pode ser impreciso ou inconsistente. Leia o artigo associado para obter mais detalhes e informações. A OKX não é responsável pelo conteúdo apresentado nos sites de terceiros. As detenções de ativos digitais, incluindo criptomoedas estáveis e NFTs, envolvem um nível de risco elevado e podem sofrer grandes flutuações. Deve considerar cuidadosamente se o trading ou a detenção de ativos digitais é adequado para si à luz da sua condição financeira.