📊 WEEKLY SNAPSHOT — Sept 29, 2025

Snapshot of market activity, protocol performance, and utilization.

🔍 Explore full analytics:

📚 Docs:

💧 Supply where it counts:

💧 1/ Total Value Locked (TVL)

• $121.68M locked (+1.29% WoW)

Liqwid TVL rose to $121.68M (+1.29% WoW) — steady growth despite wider market chop.

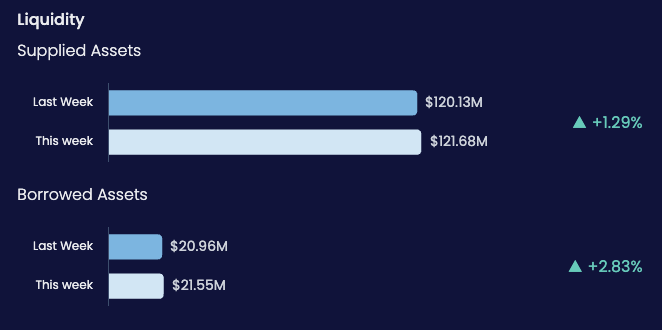

⚒️ 2/ Asset Liquidity Totals

• Supplied: $121.68M (+1.29%)

• Borrowed: $21.55M (+2.83%)

Supplied assets climbed +1.29%, while borrows grew faster at +2.83%, signaling stronger demand pressure.

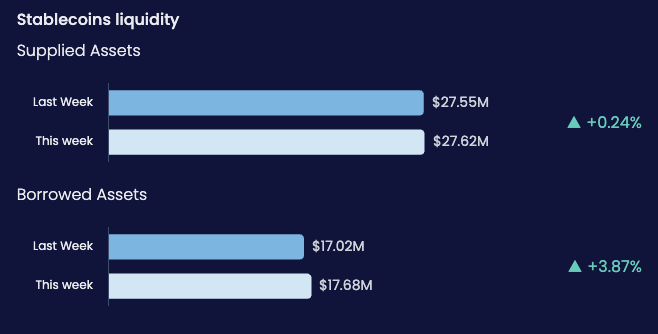

🏦 3/ Stablecoin Liquidity

• Supplied: $27.62M (+0.24%)

• Borrowed: $17.68M (+3.87%)

Stablecoin borrows hit $17.68M (+3.87%), keeping capital efficient and rates attractive for suppliers.

📈 4/ Top APY Markets (This Week)

• wanUSDC — 16.35% | $9.29M (+22.95%)

• DJED — 14.67% | $6.63M (-2.29%)

• wanUSDT — 14.35% | $2.56M (+19.86%)

• iUSD — 14.02% | $1.5M (-19.87%)

wanUSDC (+22.95%) and wanUSDT (+19.86%) saw sharp inflows, both sustaining double-digit APYs.

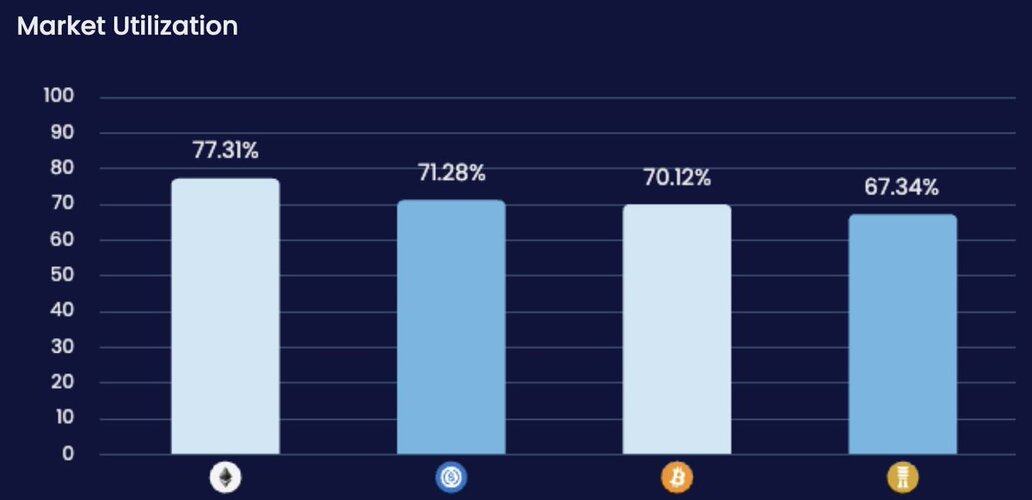

⚙️ 5/ Market Utilization (Top Markets)

• wanETH — 77.31%

• wanUSDC — 71.28%

• wanBTC — 70.12%

• DJED — 67.34%

wanETH, wanUSDC, and wanBTC each hold 70%+ utilization, highlighting consistent borrower demand across majors.

💰 6/ Revenue Breakdown (This Week)

• Debt Repaid: $259.11k (+211.84%)

• Interest Accrued: $78.29k (+3.29%)

• Fees Collected: $10.61k (+45.35%)

Weekly revenue surged — Debt repaid up 212%, fees +45%. A clear sign of active repayment cycles and healthy protocol income.

📊 7/ Capital Distribution

Supplied Assets:

• ADA — $44.81M

• wanUSDC — $9.39M

• LQ — $7.47M

• Others — $21.66M

Loan Value:

• wanUSDC — $6.62M

• DJED — $4.46M

• ADA — $3.4M

• Others — $7.06M

ADA remains the bedrock ($44.8M supplied), but stablecoins (wanUSDC $9.4M, DJED $4.5M loans) continue to anchor liquidity depth.

4,538

0

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。