🔥 The real shift happening is in #PayFi, the credit rails that power global stablecoin payments.

@ClearpoolFin| $CPOOL launching its first Credit Vault on @Plumenetwork is an inflection point. Because it connects 2 layers that matter:

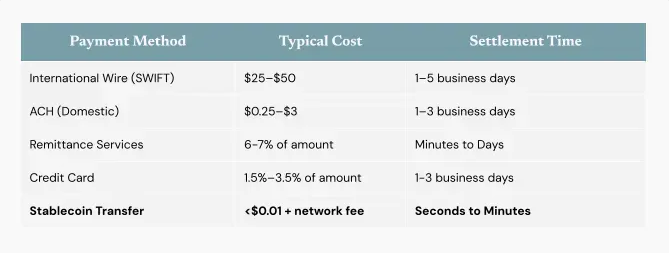

[1] Stablecoins - already the most used product in crypto, with daily volumes rivaling Visa.

[2] Credit - the backbone of payments, remittances, B2B flows. Without credit, every system needs heavy pre-funding, which kills efficiency.

Clearpool is OG to this game, since 2022 they’ve originated over $850M in stablecoin credit to big institutions like Jane Street, Wintermute, Flow Traders.

Now, they’re expanding into PayFi, serving fintechs that run retail remittances, cross-border payments, B2B rails.

These fintechs are willing to pay 1-2% premiums for instant liquidity. Because keeping payments flowing is mission-critical.

That makes PayFi one of the most profitable short-duration credit markets in the world.

By partnering with Plume, a chain purpose-built for RWAs, @ClearpoolFin is also showing what tokenization is really for -> bringing real-world payment flows onchain.

✦ My view is simple:

- RWAs started with bonds.

- The next chapter is credit.

- The endgame is payments

Stablecoins become the invisible layer moving trillions every day.

I see it as the inevitable convergence: stablecoins as money, RWAs as credit, PayFi as the bridge.

The payment flywheel is just getting started on $CPOOL.

Chads: @CryptoWizardd @thewolfofdefi @JKronbichler @CryptopepperP @wauwda @DaanCrypto @coinesper @Crypt0Xenesis @iWantCoinNews @SilverBulletBTC

1,285

0

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。