🔥 The real shift happening is in #PayFi, the credit rails that power global stablecoin payments.

@ClearpoolFin| $CPOOL launching its first Credit Vault on @Plumenetwork is an inflection point. Because it connects 2 layers that matter:

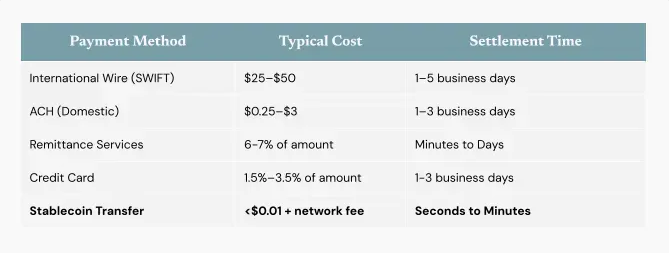

[1] Stablecoins - already the most used product in crypto, with daily volumes rivaling Visa.

[2] Credit - the backbone of payments, remittances, B2B flows. Without credit, every system needs heavy pre-funding, which kills efficiency.

Clearpool is OG to this game, since 2022 they’ve originated over $850M in stablecoin credit to big institutions like Jane Street, Wintermute, Flow Traders.

Now, they’re expanding into PayFi, serving fintechs that run retail remittances, cross-border payments, B2B rails.

These fintechs are willing to pay 1-2% premiums for instant liquidity. Because keeping payments flowing is mission-critical.

That makes PayFi one of the most profitable short-duration credit markets in the world.

By partnering with Plume, a chain purpose-built for RWAs, @ClearpoolFin is also showing what tokenization is really for -> bringing real-world payment flows onchain.

✦ My view is simple:

- RWAs started with bonds.

- The next chapter is credit.

- The endgame is payments

Stablecoins become the invisible layer moving trillions every day.

I see it as the inevitable convergence: stablecoins as money, RWAs as credit, PayFi as the bridge.

The payment flywheel is just getting started on $CPOOL.

Chads: @CryptoWizardd @thewolfofdefi @JKronbichler @CryptopepperP @wauwda @DaanCrypto @coinesper @Crypt0Xenesis @iWantCoinNews @SilverBulletBTC

1,275

0

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。